Following the trend that has continued despite the pandemic, the volume of home sales in Toronto and the rest of the GTA was way higher in November 2020 than at the same time last year, with prices substantially up, too.

According to the latest numbers released by the Toronto Regional Real Estate Board (TRREB) in its Market Watch report on Thursday, 8,766 residential property sales took place last month, which is a whopping 24.3 per cent more than November 2019, pre-COVID.

Prices, too, continue to skyrocket, up to an average of an unaffordable $955,615 — 13.3 per cent more expensive year-over-year.

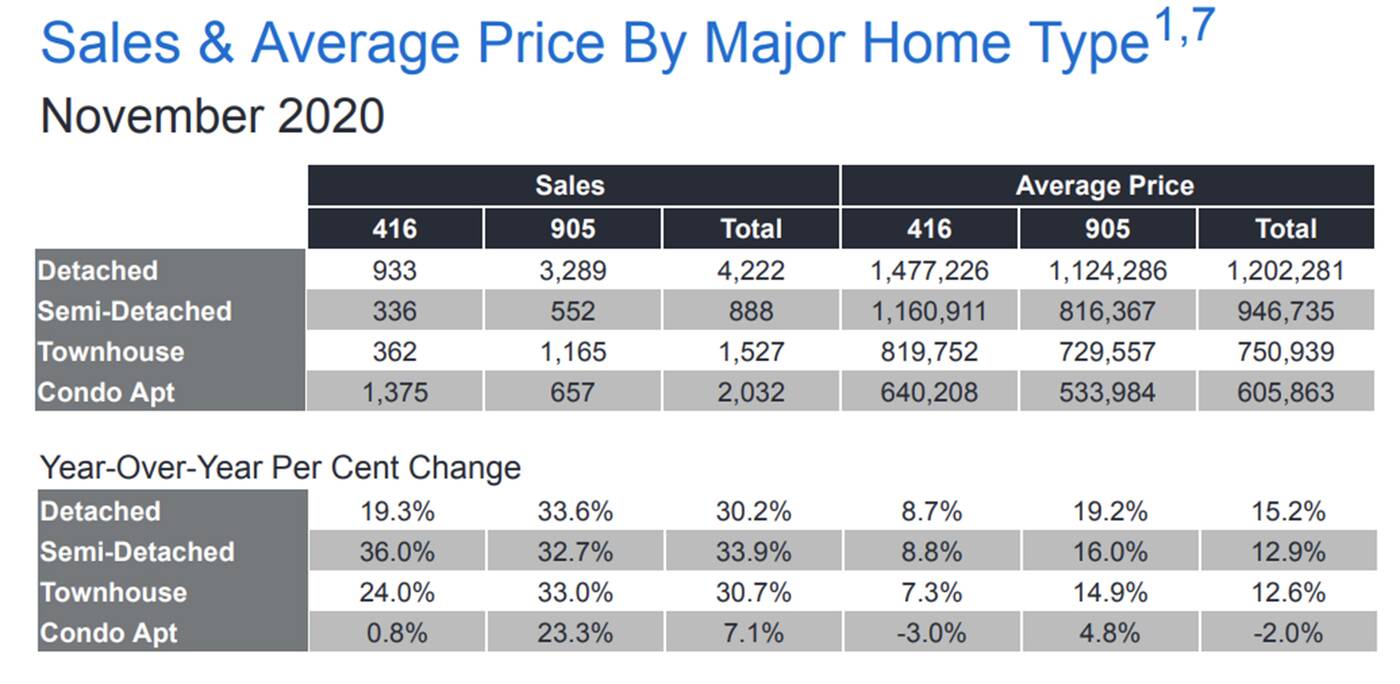

All of this is thanks to the sales of single-family homes, which have hit record highs lately, with semi-detached houses in particular driving the sales increase (numbers were up a 33.9 per cent from last year) and detached houses driving the price increase (prices were up 15.2 per cent overall from last year).

The condo market, on the other hand, has been cooling for a few months now, with sales in November up only marginally — less than one per cent in the GTA overall — and prices actually down year-over-year, largely due to a flooded market that saw nearly double the number of listings this November than last.

Chart from TRREB's November 2020 Market Watch report.

Rent prices in the city have been falling drastically over the course of this year as people realize they can move elsewhere and live cheaper now that they're working from home instead of in a downtown office.

A looming vacant home tax and new, more stringent rules for Airbnbs have also helped, as they've led to an influx of former short-term rentals into the long-term rental market, boosting supply amid dwindling demand.

This makes for a less hospitable environment for condo owners who purchased units for the sole purpose of renting them out — which is many in Toronto. Those who own units with very small footprints, especially, are looking to sell now more than ever, because not many residents are willing to spend lockdown in less than 500 square feet.

As such, the average condo price in the 416 fell 3 per cent year-over-year to $640,208. The cost of other housing types was up anywhere from 7.3 per cent to 8.8 per cent, not nearly as high as the annual price increases in the 905, which ranged from 14.9 per cent to 19.2 per cent for detached, semi-detached and townhouses.

"Generally speaking, year-over-year growth in sales was stronger for single-family homes in the GTA regions surrounding the City of Toronto, but annual single-family growth rates remained robust in the 416 area code as well," the report, which assesses resales and not the sales of new builds, reads.

"In contrast to the single-family market segments, buyers continued to benefit from much more choice in the condominium apartment market compared to last year, particularly in the City of Toronto... more options translated into a small year-over year decline in the average condominium apartment selling price in the 416."

OUT NOW!

— Toronto Regional Real Estate Board (@TheReal_TRREB) December 3, 2020

TRREB Reports Strong November Single-Family Home Resales in the GTA. Condo Market More Balanced With More Choice and Lower Selling Prices

Find the full report here: https://t.co/IaUXeY0ugY#TRREB #MarketWatch pic.twitter.com/MtEM05JJX5

But, TRREB predicts that those considering buying a condo at this time should act quick, because the buyers' market may not last for much longer as the COVID vaccine makes its way around the globe and life returns to something that more resembles normalcy.

"Once we move into the post-COVID period, we will start to see a resumption of population growth," wrote the organization's chief market analyst, "both from immigration and a return of non-permanent residents. This will lead to an increase in demand for condominium apartments in the ownership and rental markets."

0 comments:

Post a Comment